The Capital Markets Exchange:

27th June – Woolwich Works, London

Welcome to CMX 2024!

The Capital Markets Exchange, powered by The Finance Hive, brought the whole front office trading community together under one roof, with our senior Equities, Fixed Income and FX members sharing best practice frameworks, benchmarking against each other, and finding solutions to shared challenges—all in an unconventional, relaxed, and informal setting.

Set in Woolwich Works, London with stunning views over the river, a bright, airy atmosphere throughout, and the ability to combine indoor and outdoor space, it was the perfect setting for the immersive experience of CMX.

Upon arrival, our attendees were handed their sustainable Blendology badges, colour-coded by asset class, which allowed them to see their personal agendas and tap with others to exchange details. Through Blendology 4,788 individual connections were made at CMX.

Along with the badges, our Innovation Stage sessions, roundtable discussions, Head Trader Think Tanks, and workshops connected the entire trading community, with a backdrop of live music, games, entertainment, and delicious food and drink.

Buy side registered

Hand-picked, best-in-class partners

Speakers, storytellers and moderators

The Innovation Stage

We heard from a line-up of cutting-edge industry leaders throughout the day during exclusive, 20-minute talks. We had panel discussions with a representative from each part of the trading value chain for sessions spanning multiple asset classes, or tailored to asset-class specific cohorts to provide key industry updates.

Our wonderful host and moderator, David McClelland kicked off the day, welcoming our attendees to the fabulous Woolwich Works, setting a positive tone for the exciting sessions ahead.

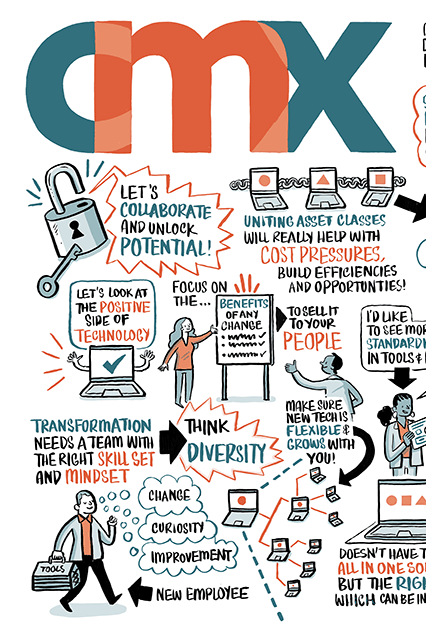

He was then joined by Lynn Challenger, Global Head of Trading at UBS Asset Management for a session on crafting a dynamic, Multi-Asset trading hub. Lynn shared insights into excelling across diverse asset domains by focusing on people, processes, and technology. From maximising Cross-Asset efficiency through analytics to powering a thriving Multi-Asset hub with unified tech solutions, this session was packed with forward-thinking strategies.

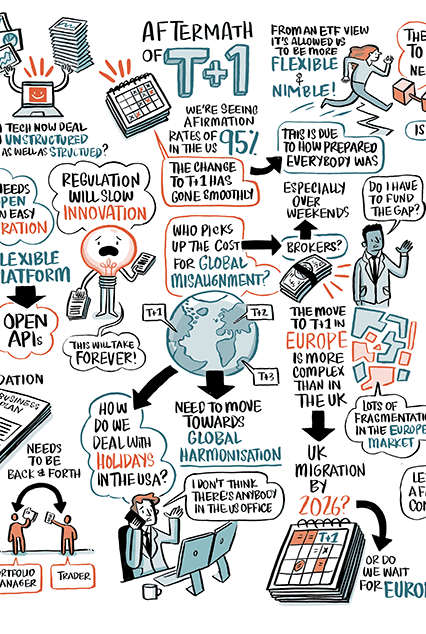

We also explored several other topics, such as the path to scalable trading, harnessing the power of AI, the aftermath of T+1, and lots more. These discussions sparked reflections on reshaping trading days, integrating AI into our desks, and fostering Cross-Asset collaboration for seamless end-to-end workflows.

Roundtables

In usual Finance Hive style, our roundtables at CMX were under Chatham House Rule, but here’s some anonymised insights we gathered from these discussions…

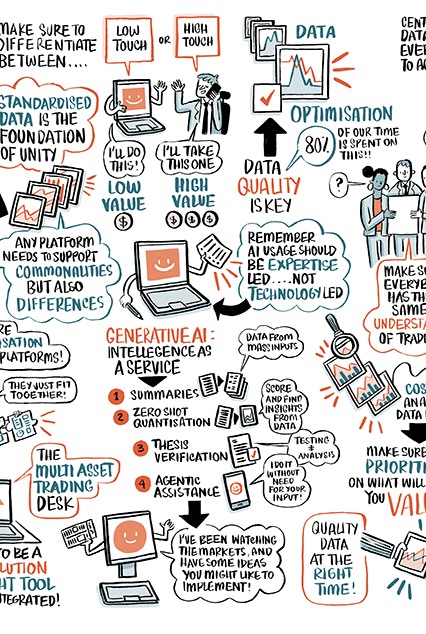

When discussing workflow optimisation through rules-based automation and pre-trade TCA, members suggested building an API into your EMS to effectively monitor the trade difficulty of single stocks. Cluster scores were also identified as a useful development for all asset classes. However, members stressed the need for better pre-trade tools, suggesting that we’re only just scratching the surface here…

We also delved into best practices for intra-day and post-trade TCA. Key insights included: leveraging data analytics to pinpoint inefficiencies, and implementing real-time adjustments to trading strategies. Data integration and ensuring accuracy were at the fore-front of discussions.

FlexTrade hosted a roundtable on optimising FX workflows through rules-based automation and pre-trade TCA. A significant focus was on integrating and evaluating data from various sources, which was identified as crucial for optimising trading decisions. The automation of processes, especially in Emerging Markets (EM), was highlighted as essential for managing trading volumes and complexities, with specific thresholds set for different market segments.

Efficiency in trading strategies was another key topic. The discussion covered optimising workflows based on trade volumes and balancing low-touch (automated) and high-touch (manual) trading. Integrating vendor platforms and EMS was seen as a vital step towards reducing manual effort and enhancing operational efficiency.

Regulatory considerations were also emphasised, with a need to comply with regulations without compromising efficiency. Data analysis plays a crucial role in informed decision-making, helping to evaluate the cost and efficiency of automated processes vs. manual trading.

Our members also addressed challenges in managing operational complexities across different market tiers and the importance of reliable data management. Future innovations in FX trading workflows were explored, highlighting the potential for technological advancements to further enhance trading efficiency and effectiveness.

Workshops

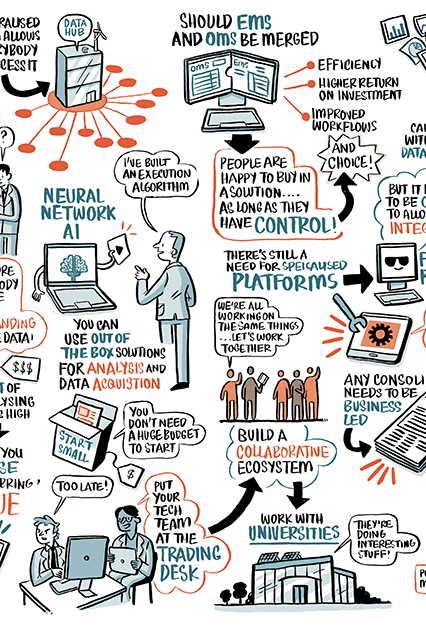

Goldman Sachs led discussions on the evolving market structure and credit opportunities in Emerging Markets. A significant shift from traditional voice-based trading to electronic trading was noted, particularly in developed markets, with growing adoption in EM.

Liquidity challenges—especially during market stress periods, such as the COVID-19 pandemic—were highlighted, emphasising the role of local banks in providing liquidity.

The workshop also covered trading protocols, with a focus on the effectiveness of portfolio trading, voice-based trading, and algorithmic execution. Technological advancements and innovations were discussed as crucial for enhancing trading efficiency. Participants stressed the need for regulatory engagement to balance transparency with market efficiency, and the importance of strong client relationships in maintaining trust and satisfaction.

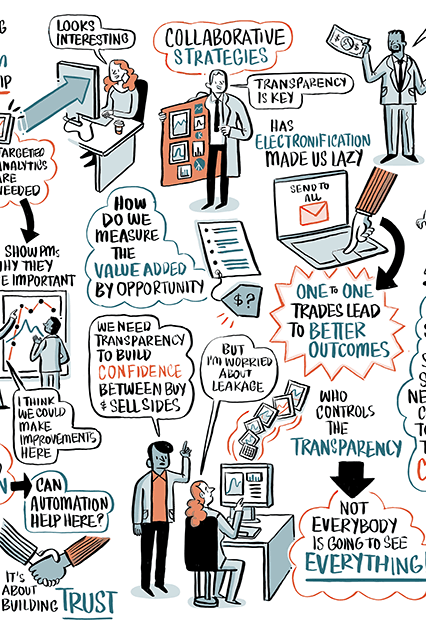

Head Trader Think Tanks

We hosted a Head Trader Think Tank session to discuss key strategies for enhancing the value of trading desks. The focus was on executing trades, implementing portfolio strategies, and managing risk. Here’s a flavour of what our members discussed…

Collaboration with portfolio managers ensures alignment with broader goals, and navigates liquidity and compliance challenges.

Technological advancements, including electronic trading platforms, automation, and data analytics were highlighted to improve efficiency. Remote work poses communication and productivity challenges, with strategies like virtual meetings and performance monitoring going some way to help maintain team dynamics and regulatory compliance.

Food and Entertainment

Amongst the jam-packed, interactive sessions, we ensured everyone stayed refreshed and entertained with a wide range of mouth-watering food and drinks, and a selection of competitive games. It was the perfect way to spend a networking break, offering both relaxation and conversation starters.

From Scalextric races to a golf simulator sponsored by Brown Brothers Harriman, the activities were a hit! Participants also enjoyed a game of giant Jenga and table football, while a wandering band added to the lively atmosphere, inviting song requests from attendees.

As the sun set on Woolwich Works, happy hour rolled in, kicking off The Finance Hive Summer Social. With sponsored cocktails from Galaxy, an array of delicious dumplings, and thousands of badge connections, we ended CMX 2024 with a bang!

“My highlight was the Innovation Stage content. We conducted a lot of the on-stage conversation under Chatham House Rule, which meant that high-profile members of the front office community used their ‘personal’ voice to talk about key issues with a level of honesty and authenticity, which is not often seen at other industry events. And of course, it was wonderful to see the CMX team in action, working collaboratively and supportively to deliver a unique and memorable experience for our members and partners. Having fun, working hard, delivering value!”

Sally Green, Co-Founder

Team Highlights

“The biggest highlight for me was the amazing atmosphere onsite at Woolwich Works. CMX really did things differently, and I think everyone felt it was a breath of fresh air which focused on addressing the challenges being faced by the buy side, all in an informal and relaxed setting with an emphasis on open, honest discussions amongst peers. It was also great to see so many new faces, with many taking the opportunity to bring the team along to divide and conquer all of the different discussions taking place over the day.”

Liam Heraty, Director

“CMX had a great buzz, and I loved the openness and ideas bouncing around at the Head Trader Think Tanks in particular!”

Frances Rose, Head of Content

“CMX! Wow. Designed to be disruptive and to change the way the front office collaborates, I couldn’t be more happy! The highlight for me was seeing all of our amazing members and partners’ faces as they walked into the open air courtyard at Woolwich Works with the food trucks, stilt walkers, games and of course, their peers! The relaxed feel to the event, alongside the amazing content was hard to beat! Here’s to next year…”

Ben Nash, Partnerships Manager

“CMX was a game-changer! It was amazing to watch it come to life for the first time after all the team’s hard work, and I’m so excited to see what’s in store for next year! It was the perfect mix of content and fun—something you won’t find anywhere else!”

Ellie Roston, Marketing Manager

“CMX redefined capital markets’ events, and was a dynamic, new platform for the modern, front office trading community to discuss the latest and greatest innovations across FI, EQ, and FX markets. Let’s bring on next year!”

Becky Moore, Community Manager

“Spending time with the whole team! All of us coming together to celebrate the amazing buy side community we have built as we disrupt the industry!”

Evie Twyford, Community Director

“CMX was an amazing first event for us, bringing together all asset classes. It was great to see some new and familiar faces among the buy side, and I’m looking forward to next year!”

Alexandra Bond, Growth Executive

“Seeing the whole event come together, the smiles and excitement on attendees’ faces as they arrived and collected their Blendology badges, to learn that they only need to tap to exchange details. The food, the atmosphere, and the weather were amazing too.”

Dee Champaneri, Senior Event Manager

Don’t Miss Out!

“Seeing CMX come together after all the team’s hard work was truly spectacular. We didn’t just put on a capital markets event, we disrupted the industry and demonstrated that uniting the full front office in one place at one time is possible!”

Holly Kirkpatrick, Marketing Executive